in house financing meaning

Even though lenders no longer work with buyers and sellers allowing loan assumptions acquiring properties subject-to existing financing continues. For example on a 300000 home.

What Is Financing A Car And Is It A Good Idea For You Credit Karma

In-house financing is financing that businesses offer directly to buyers to make it easier for them to afford large purchases such as.

. In-house financing is a type of loan provided by a business directly to a customer allowing them to purchase goods and services offered by the business. If your credit is less than ideal or you have yet to establish credit in-house financing may provide more flexibility for loan approval. In-House Financing Definition Meaning Example Banking Business Terms Loan Basics.

Depending on your credit situation and needs in-house financing can be a great option if you. A firm uses its own employees and time to keep a division or business. This kind of financing.

In-house financing reduces the firms dependency on the banking sector to provide monies to the client in order for the transaction to be completed. In-house financing dealerships sell cars and fund auto loans all in one place. This could mean a higher interest rate.

In-house financing means that you borrow money directly from the dealership to finance your new vehicle. With dealer-arranged financing the dealer collects information from you and forwards that information to one or more prospective auto lenders. Everything you need to know about In-House Financing from The Online.

Yes it is legal. The car is the loans collateral meaning that if you default on the loan the lender. In-house financing simply means that you borrow money from your car dealership.

Financing directly with your car dealership. An in-house financing loan is a car loan directly from the dealership youre buying a car from. Alternatively with bank or.

What Does In-House Financing Mean. In-house refers to conducting an activity or operation within a company instead of relying on outsourcing. Often called buy here pay here dealerships in-house financing dealerships let.

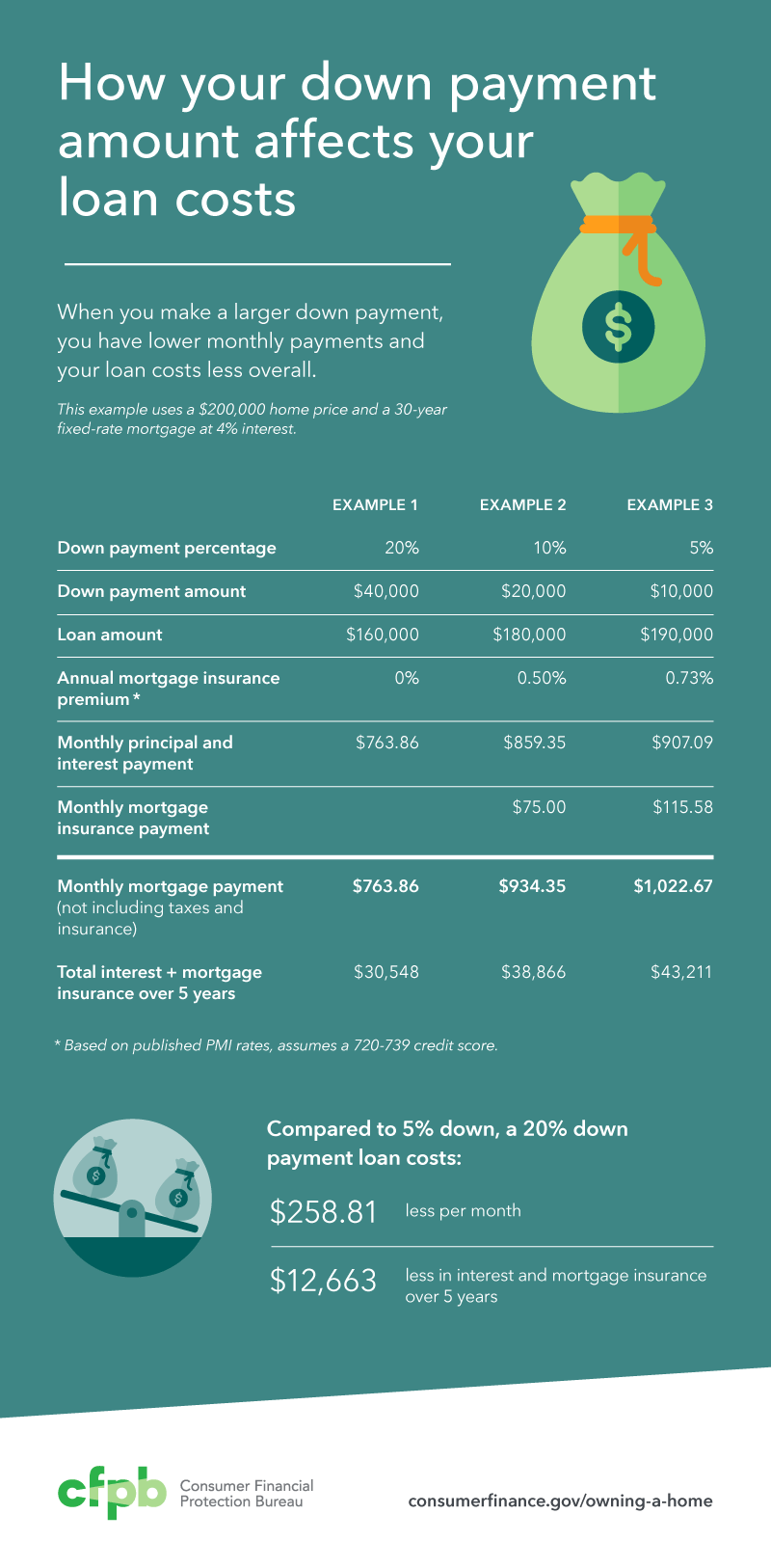

With in-house financing the. Federal Housing Administration FHA loans usually require a 35 down payment. Thats quite a bit less than 20 percent but can still be a lot of money.

You then make loan and interest payments to the dealership.

Fha Loan What To Know Nerdwallet

In House Financing Vs Bank Financing A Future Homeowner S Guide

In House Financing Definition And How It Works

Sebastian Rivera At Intercoastal Mortgage Nmls 190984 Looking For A Home But Concerned About The Rising Interest Rates At Icm We Ve Got An Amazing Portfolio Product Meaning Only We Re The Only

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau

Best Mortgage Lenders For October 2022 The Ascent

Different Types Of Mortgage Loans

Loan Vs Mortgage Difference And Comparison Diffen

Buying A Car Before Buying A House What S The Right Order Credit Com

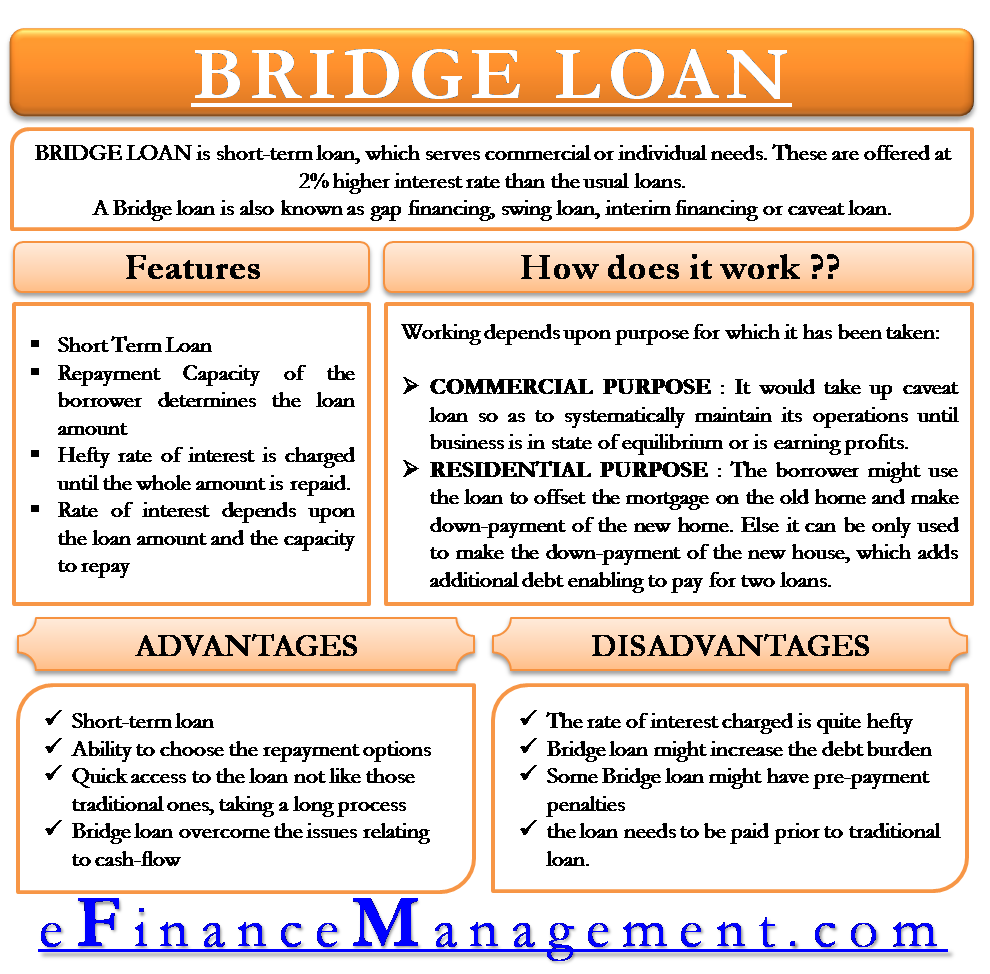

Bridge Loan Meaning Features How It Works Pros And Cons Efm

The Ultimate Guide To Owner Financing Live Youtube

How To Finance A Car With Carvana

Some Home Loan Lenders Put People At Risk How S Your Mortgage Compare

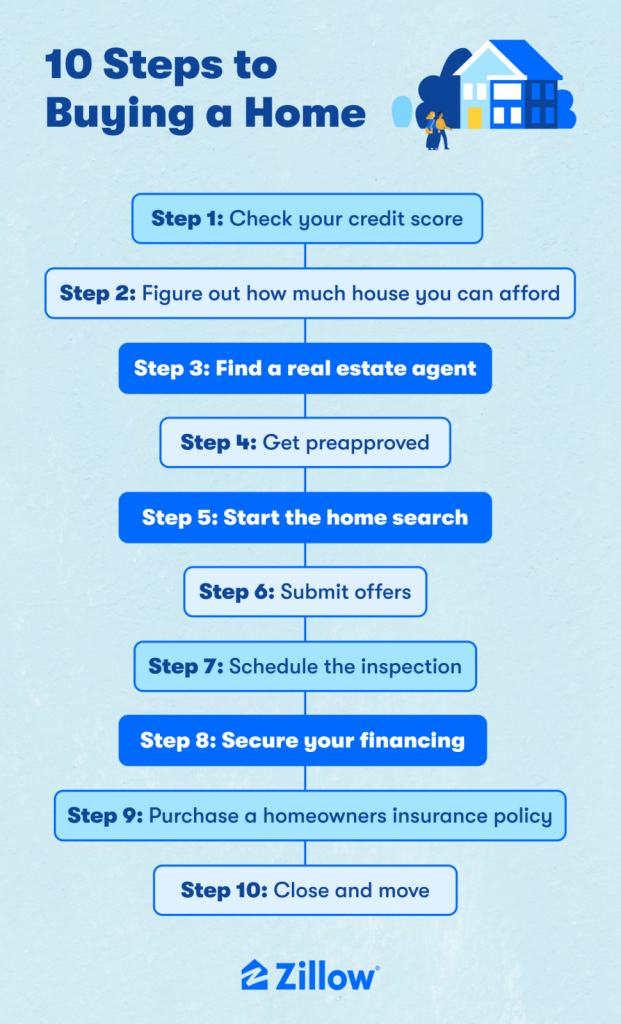

How Does The Mortgage Loan Process Work Rate Com

What Is In House Financing Finding In House Financing Car Dealers

:max_bytes(150000):strip_icc()/best-auto-loan-rates-4173489_FINAL-84fa7faff6244117a47e6641978a86dc.png)